Their Finances

UI UX

Project Overview

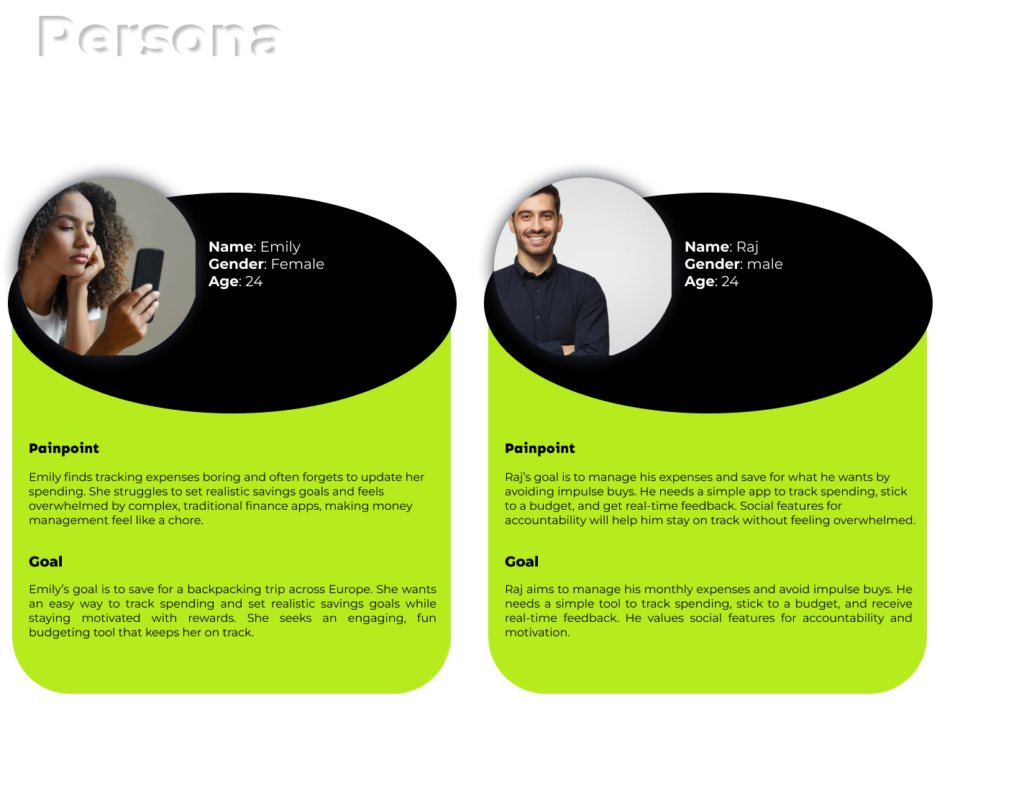

Gen Z users face significant challenges in managing their finances due to the complexity and lack of engagement in traditional finance apps. These apps are often seen as dull, difficult to navigate, and not tailored to the fast-paced, digital-first lifestyle of younger users. As a result, many Gen Z individuals struggle to develop healthy financial

habits and avoid building savings.

Challenges

Designing a financial app for Gen Z comes with unique hurdles that need careful consideration. The challenge is not just about creating an app, but about crafting an experience that resonates with younger users who are digital natives but also need effective tools to manage

their finances. Here are the key challenges faced during this project

Insight

We have picked out three main items from these issues as our priority.

1: Gen Z Values Visual Engagement

Gen Z prefers visually engaging, interactive apps with clear, dynamic visuals over text-heavy interfaces. Bright colors, playful animations, and intuitive design elements keep them motivated and engaged. This insight led to using vibrant colors, custom illustrations, and micro-interactions to make financial tasks fun and approachable.

2: Instant Gratification Drives Motivation

Gen Z values immediate results and real-time feedback. Features like progress bars, instant rewards (badges, confetti), and notifications for small wins keep them motivated and make financial management feel rewarding.

3: Social Influence Plays a Key Role in Engagement

Gen Z values immediate results and real-time feedback. Features like progress bars, instant rewards (badges, confetti), and notifications for small wins keep them motivated and make financial management feel rewarding.

Priority

Matrix

We analyzed all identified issues and used a priority matrix to determine which problems were major and easy to solve. This helps us establish our order of priorities for resolution.

Definitive

Solution

After exploring various “How Might We” possibilities, we’ve developed design solutions that resonate with Gen Z’s preferences, making the experience both fun and functional. Our approach ensures these solutions tackle the specific challenges Gen Z faces with financial management while keeping the design engaging and user-friendly.

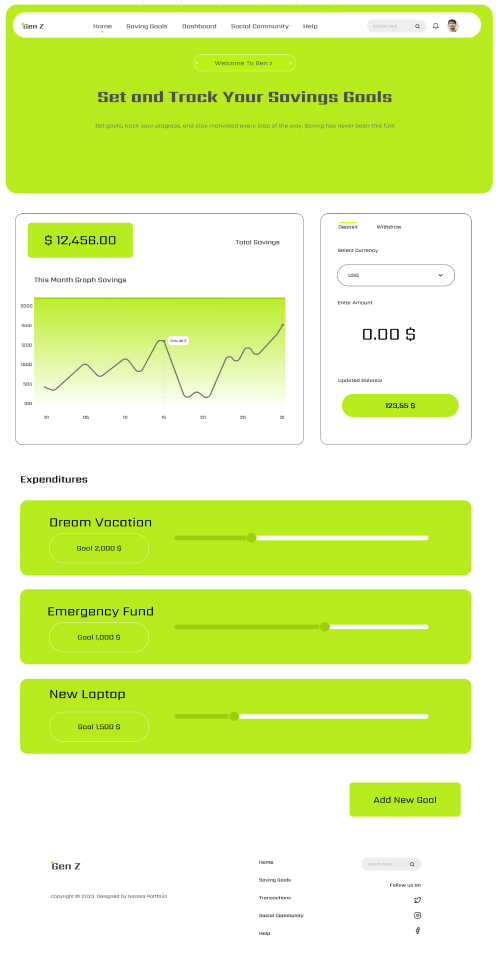

1. Gamified Financial Management

By incorporating gamification features like progress bars, achievement badges, and rewards (e.g., confetti for completing a savings goal), we make financial tasks fun and engaging, encouraging Gen Z users to stay on track with their budgeting and saving.

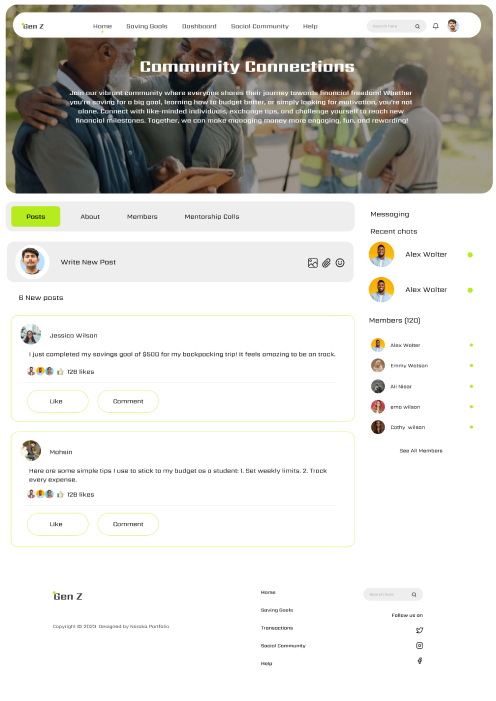

02. Social Challenges and Community Engagement

Enabling users to join group challenges, share milestones, and compete with friends creates a sense of accountability and community. This social aspect fosters motivation and long-term engagement, turning financial management into a shared experience rather than a solo task.

03 Minimalist and Interactive Design

The app features a clean, visually appealing interface with intuitive navigation, bright colors, dynamic charts, and playful animations. This keeps Gen Z users motivated and reduces the overwhelming nature of financial apps, making the user experience both approachable and enjoyable.

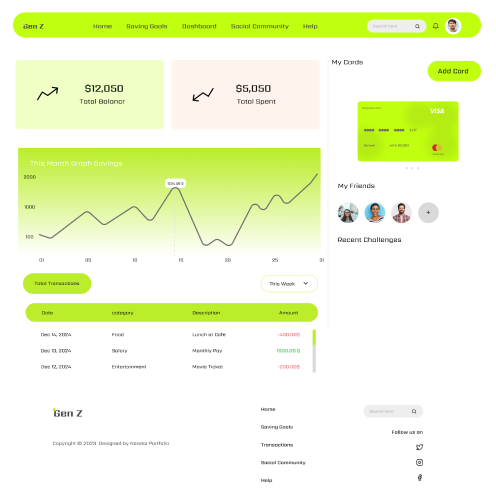

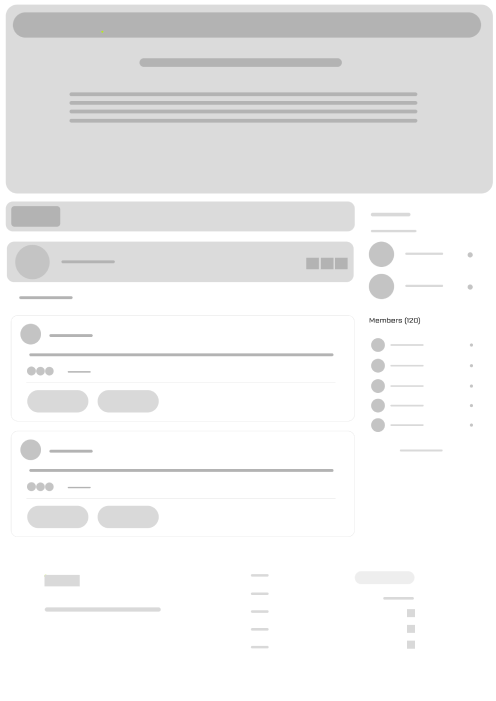

Wireframe

The wireframes focused on mapping key user flows, such as game discovery, purchasing, and community interactions. These low-fidelity designs helped refine the platform’s structure and navigation, ensuring a smooth and intuitive user experience before finalizing the high-fidelity design.

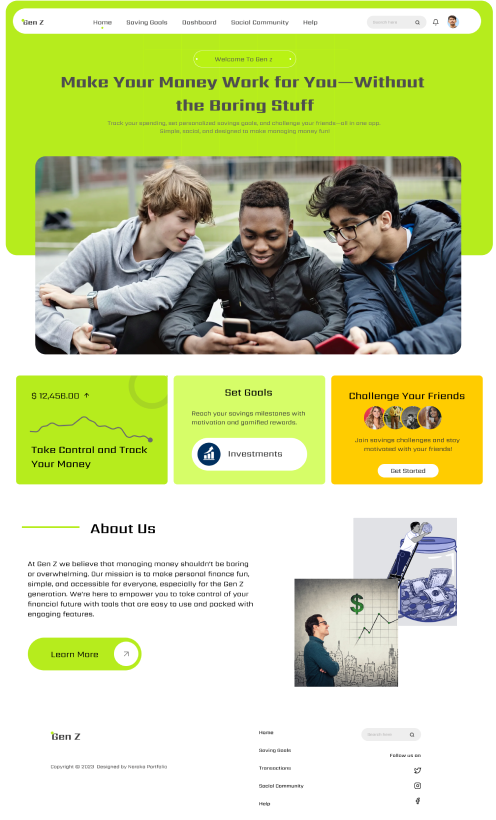

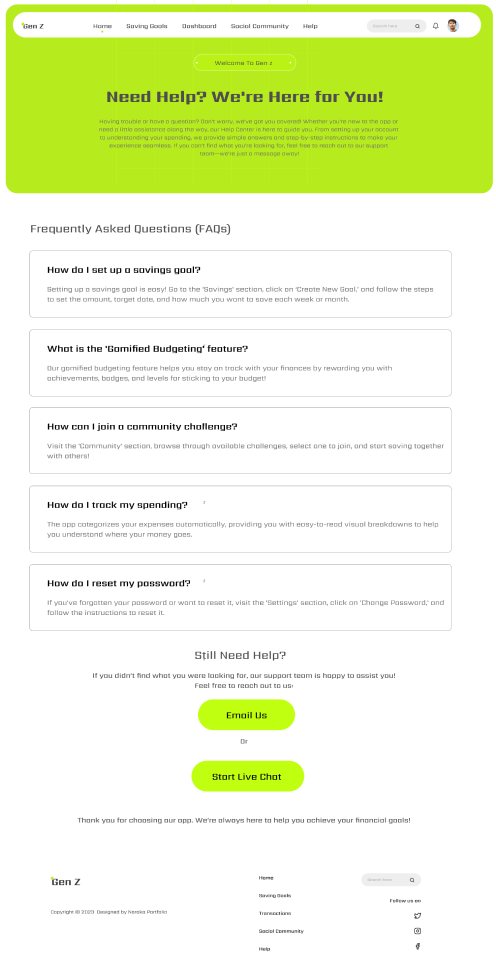

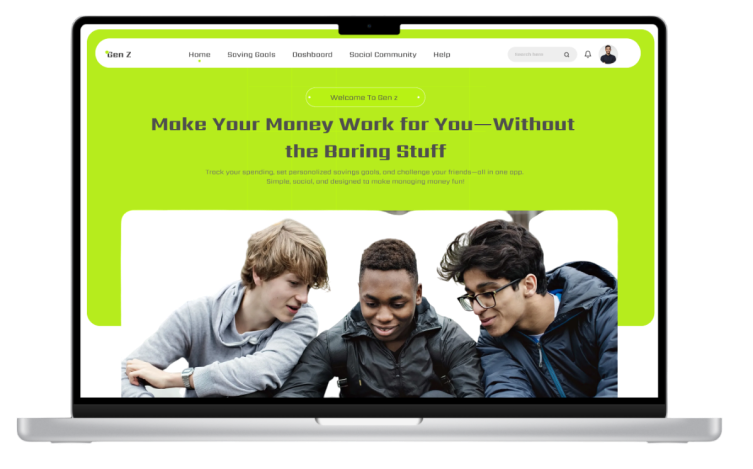

Final Design

We revamped the existing interface to streamline user flows and enhance clarity, focusing on reducing visual clutter. Key features like game discovery, purchases, and community interactions were reorganized for better accessibility and ease of use..